How to tell a story with data

An in-depth guide on how to turn data into business impact — full of real-life examples and tactical tips to apply on the job

Today’s post is a collaboration with Tessa Xie from

. I like to think about Diving into Data as “The Operator’s Handbook” specifically for Data Scientists and Analysts. My typical reaction after reading her posts is “I wish I had written that”, so the logical step was to team up. If you can’t beat them, join them.In her newsletter, Tessa shares actionable advice on topics ranging from how to get a job in data to solving business problems with data and communicating more effectively — based on her experience as an Analytics Consultant at McKinsey and Data Science Manager in Tech.

If you haven’t, I highly recommend you check it out here.

As long as humans have existed, they have told stories. For example, the cave paintings in Lascaux, France, are over 30,000 years old and show traces of early graphical storytelling.

And stories still play a central role in our lives today. Ask yourself:

How much do you remember from the last slide deck you saw at work? Probably not much

But how much do you remember from The Lord of the Rings or The Office [or whatever book / movie you like]? Chances are, you can quote entire scenes

If you want to get your point across and make a lasting impression, you need to wrap it in a narrative. Sometimes, people who work with data think they’re an exception to this. Data represents cold, hard facts – that should be convincing enough, no?

But this couldn’t be further from the truth. Data by itself doesn’t drive any impact in a company; you can only unlock business value when you get people to care—and ultimately take action—by showing what the data means for them.

In this post, we’ll cover:

What data storytelling is and isn’t, and why it matters

How to package data into a compelling narrative

How to visualize data for clear takeaways

Best practices and what to avoid when presenting data

Let’s get into it.

What is data storytelling, and why does it matter?

Let’s get the most important thing out of the way:

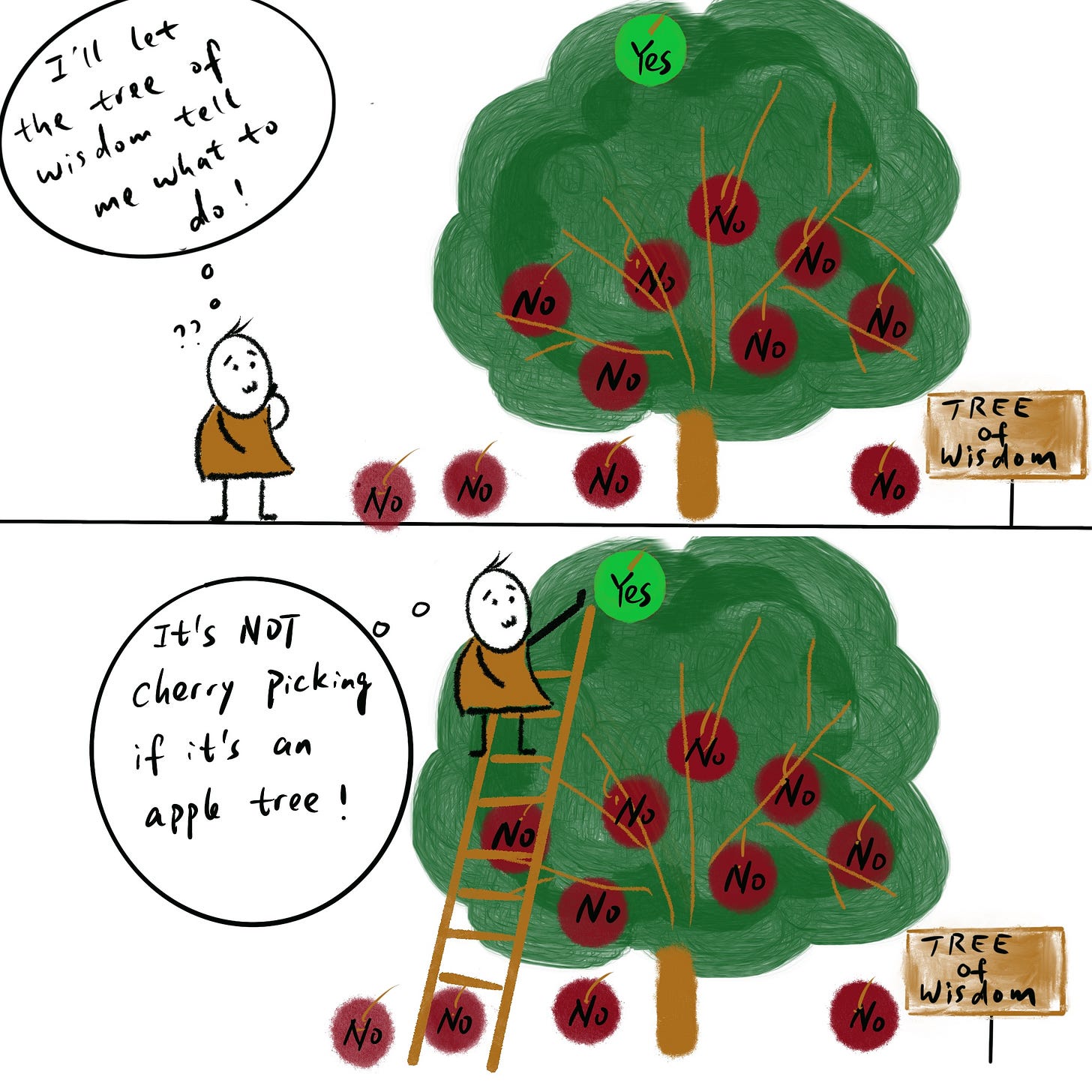

What data storytelling is: Organizing data into a compelling narrative, putting it into context and deriving a “so what?”

What data storytelling isn’t: Cherry picking or twisting data to support a preconceived narrative

In some organizations, data storytelling has a bad rap because managers use it to put a spin on metrics and hide areas of subpar performance in their department. As a result, some executives only want to look at “unadulterated” raw data.

But that’s an overreaction. Instead of outright banning it, we should make sure to follow best practices to maximize the business impact without misleading our audience.

We will cover those best practices here.

Narratives drive decisions and outcomes

Ultimately, any analysis we do at work is supposed to drive a decision.

What do we build?

Which customer segment should we focus on?

Should we expand internationally, and if so, into which markets?

Any good analysis should start with a business problem that needs to be solved, and should end with a clear narrative that argues what should be done going forward.

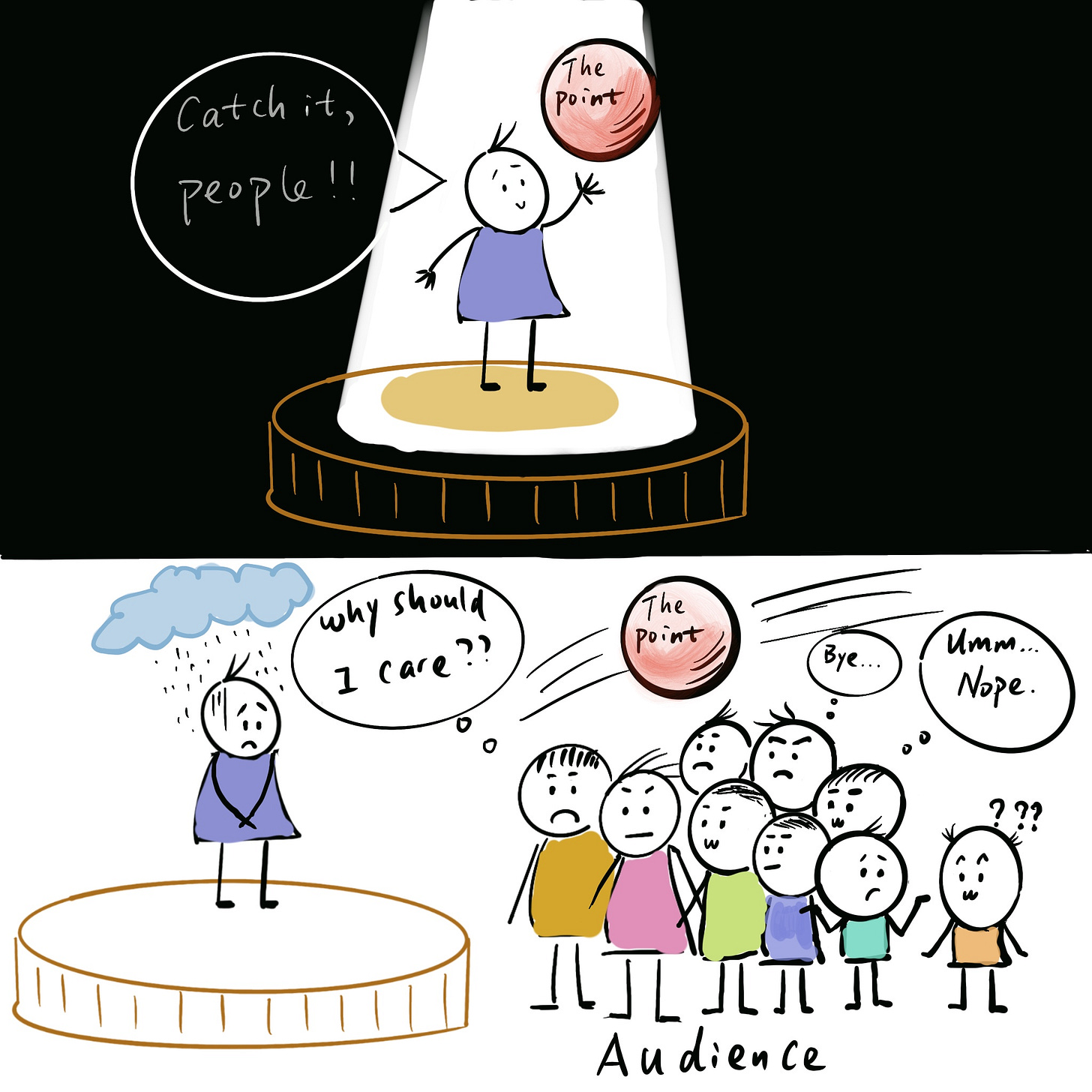

If you don’t create a narrative and only present raw data (e.g. “random” sets of charts in a slide deck), you are leaving the work of making sense of the data to your audience.

Best case, your audience arrives at the right conclusions with tons of effort and resents you for the headache.

Worst case, the point is going right over their heads.

Telling a story allows you to take control of the narrative, avoid misinterpretations and get everyone aligned on a path forward. This is needed in a number of common scenarios:

Leadership updates

Leaders have limited time and lack the detailed context that the people working on the problem have. So it’s up to you to help them understand what’s going on.

Investigations

When you’re doing an investigation (e.g. into a metric drop), you need to get a joint understanding of what has happened so you can move forward.

If you don’t, different teams will be sharing different versions of events and things will get confusing quickly.

Influencing stakeholders

Data is great when you’re trying to get others to do things. Instead of just saying “I think you should do this”, you can make the whole thing more objective and say “Based on the data, we should do this because of X and Y”

If someone wants to push back, they now need to disprove your analysis or counter with another data-driven argument.

How to package data into a compelling narrative

Creating a narrative involves three steps:

🔍 Identify your audience and what matters to them

🧵 Tailor your narrative to your audience

💬 Deliver your narrative for maximum impact

Let’s take a closer look at each one.

Step 1: Identify your audience and what matters to them

You need to make people care about your message if you want to get through to them.

And if you want people to care, you need to understand what matters to them:

What are their big strategic priorities for the year or the quarter?

What are their goals, and what metrics are they measured on?

What’s going well, and where are they struggling?

For example, you might find that the Product Director you’re working with is mostly focused on growing engagement for a new experimental bet they launched and that they are behind plan.

If you can establish a connection between the data you’re presenting and engagement growth on their product, you’ll have their undivided attention.

Step 2: Tailor your narrative to your audience

Once you know what your audience cares about, you have to create a narrative that’s specifically tailored to that. This can mean highlighting different data points, or framing the same data points differently.

Ask yourself:

Based on the data you analyzed, what should they be doing differently?

This is helpful for two reasons:

1) Presenting something surprising captures people’s attention; if people walk away thinking “Well, that was obvious”, they likely won’t remember it and it means your analysis just scratched the surface

2) You’re adding immediate value because you’re giving them something they can apply right now

Once you have people’s attention, you need to keep it. That means you should focus only on the parts that are truly relevant to your audience.

Deciding what not to include is just as important as deciding what to include.

Step 3: Deliver your narrative for maximum impact

Even if your narrative is jam-packed with data-driven insights; if you don’t deliver it right, it won’t lead to any real business impact.

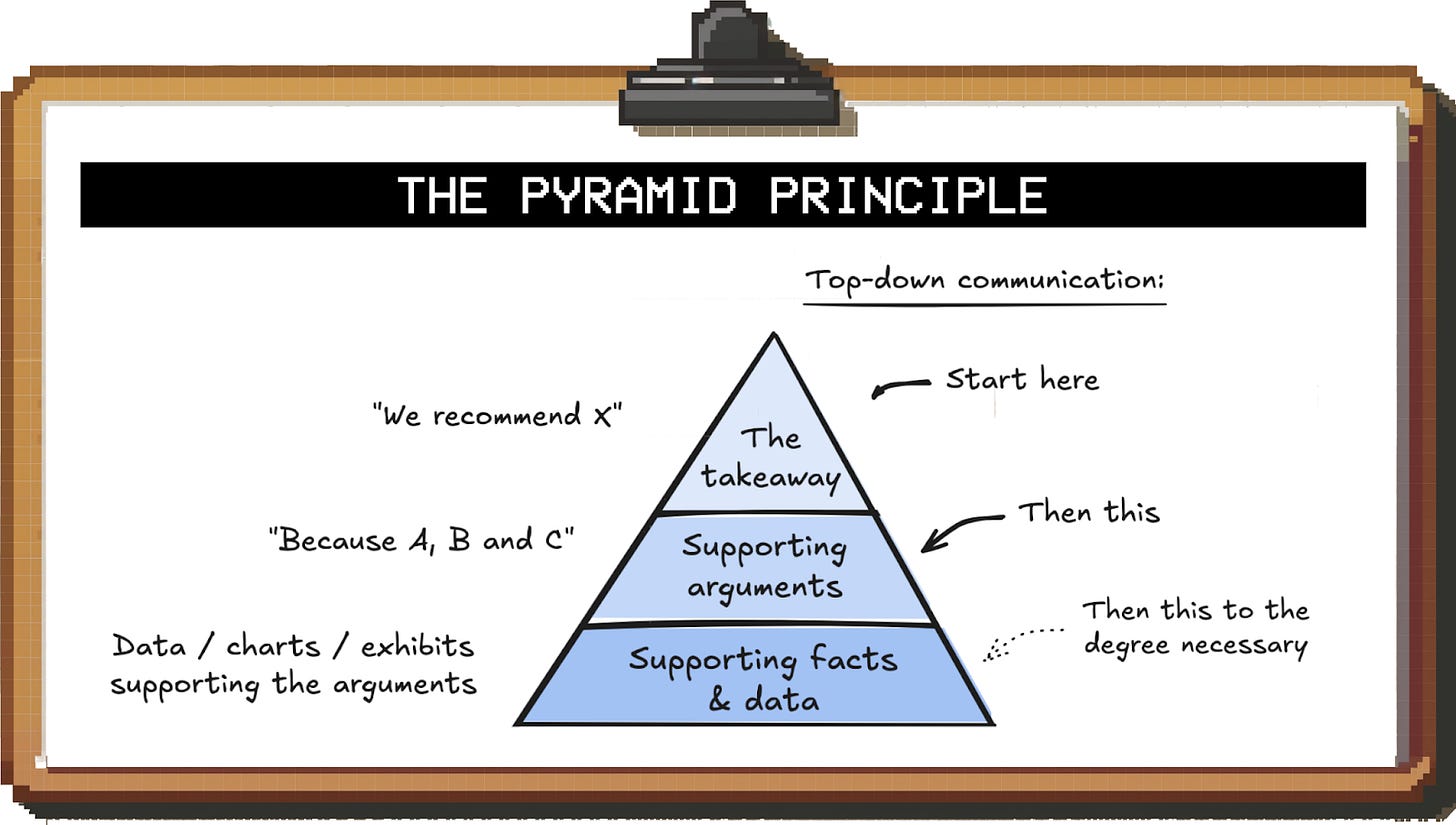

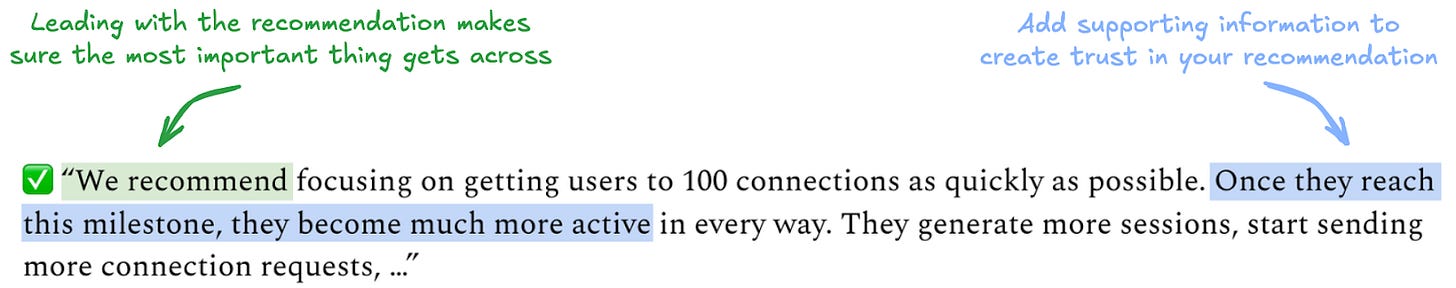

You’ve heard us talk about this before (e.g. here and here), but no article on data storytelling can be complete without mentioning the Pyramid Principle. If you already know it, feel free to skip ahead to the next section.

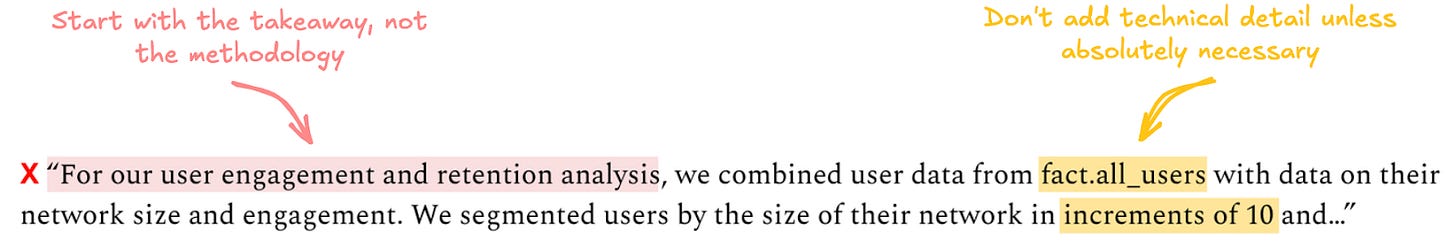

Most data people tend to talk about their analysis chronologically and focus too much on technical details:

By the time you get to the insights, everyone has tuned out. Instead, start with the relevant takeaways for your audience and then go deeper by offering supporting arguments and data:

How to present data for clear takeaways

If you present data the right way, it tells a story all by itself without needing much commentary.

This is your most powerful data storytelling tool: A chart with a single clear takeaway will give your message a massive boost in credibility, while an ambiguous chart will result in debate that can derail your narrative.

Here are some of the most common scenarios you’ll come across with real life examples on how to effectively visualize the data:

Benchmarking

Benchmarking tip #1: How to compare trajectories

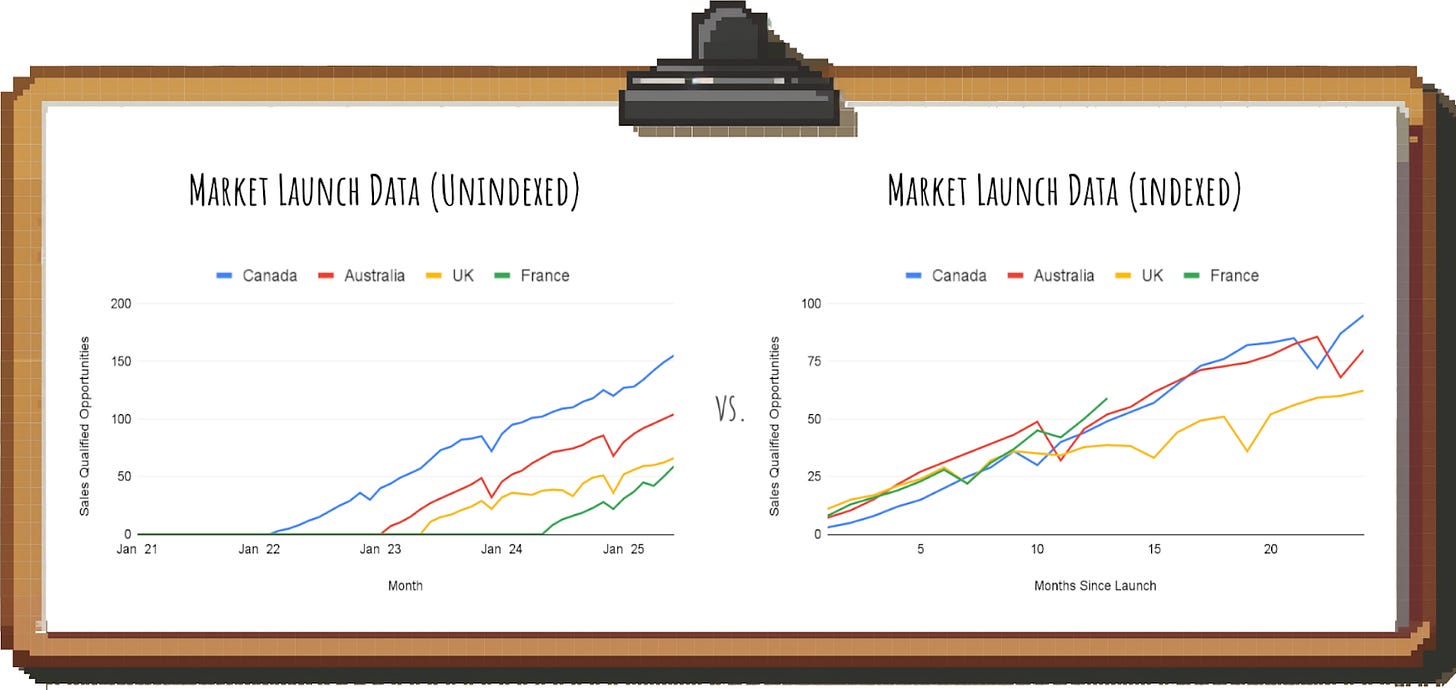

Let’s say you’re trying to report on the performance of a newly launched market.

If you simply put the performance data for the new market next to the data of the established ones, people will either think it’s doing terribly, or they won’t know how to interpret the data.

But this isn’t a fair comparison; the established markets had months or even years to improve over time, while the newly launched market is still ramping up.

✅ The fix: Indexing the data by the launch date for each market1. That way, you can compare the trajectories and see if the most recently launched market is developing better or worse post-launch.

This way, you can see clearly that France is growing slightly faster than the other markets, despite having the lowest numbers as of today.

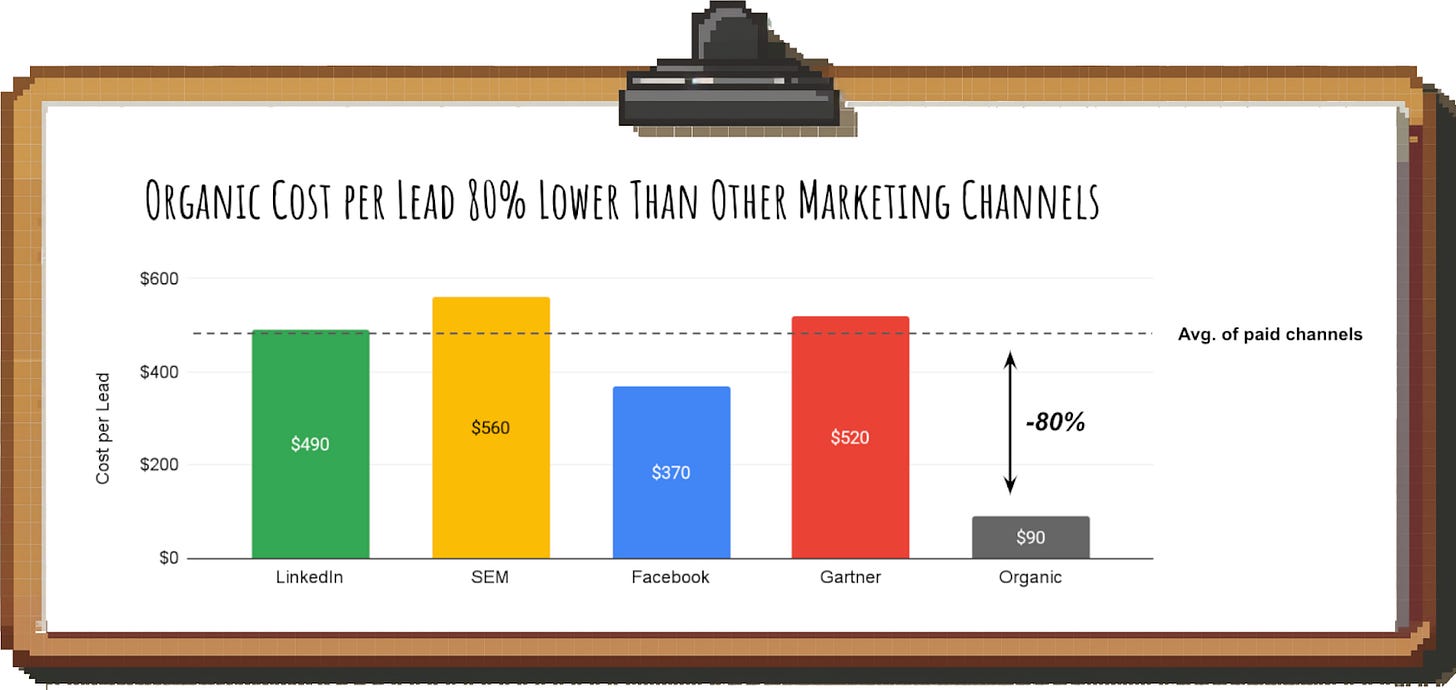

Benchmarking tip #2: Don’t compare apples to oranges

If you pick the wrong metrics or don’t add enough context, you risk comparing apples to oranges.

For example, take a look at this chart:

If you present this without any explanation, your audience will likely think “We should just scale Organic; it’s super efficient!”.

But this comparison is misleading.

Your paid channels like LinkedIn and SEM can be scaled somewhat linearly by investing more money in ads. Organic, on the other hand, is much harder to influence (depending on what your attribution counts into “Organic”, you will have to invest in SEO, content, and your brand efforts, which can take months to show results).

Takeaway: Pick the right comparisons, and clearly communicate any caveats.

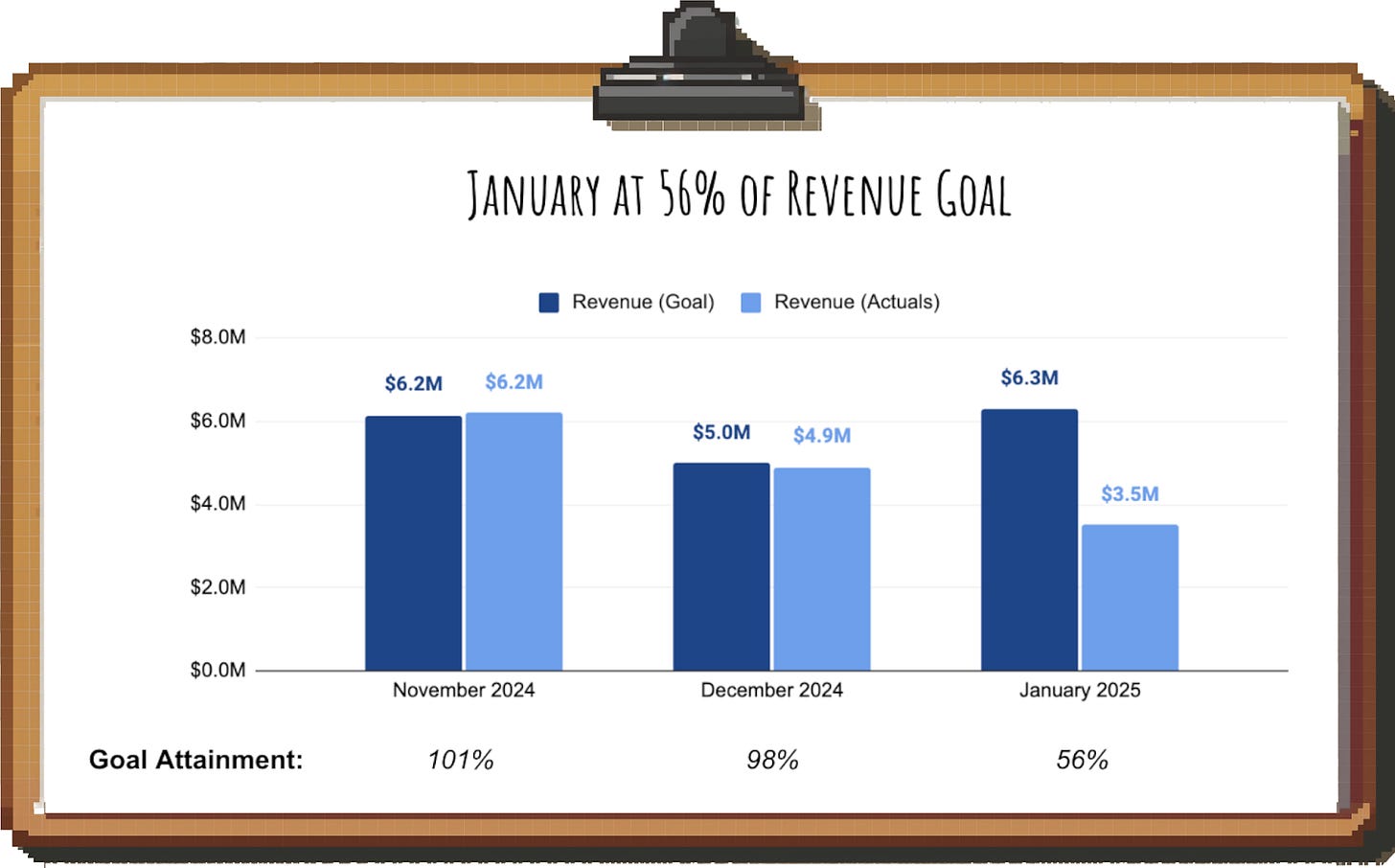

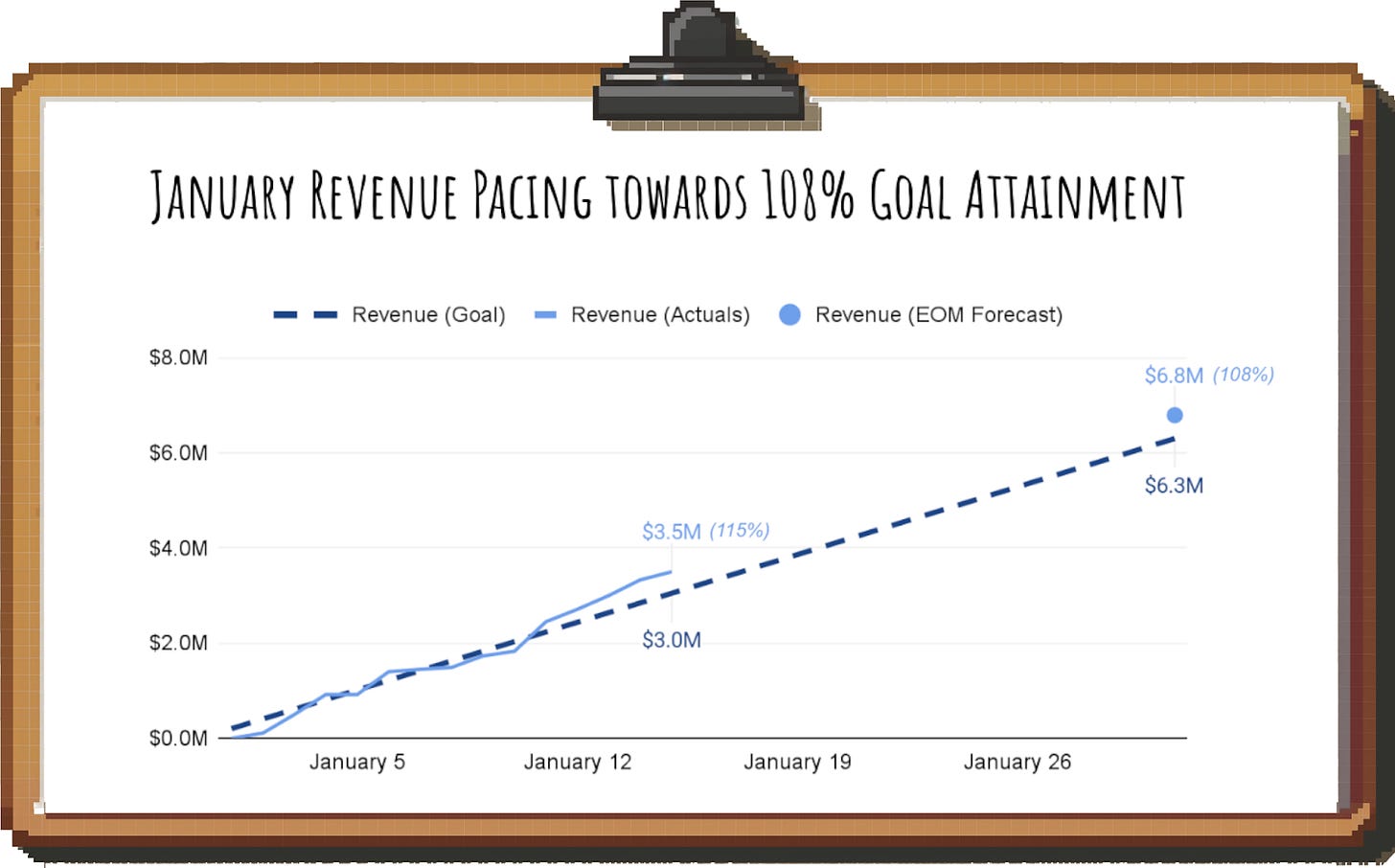

Benchmarking tip #3: How to compare actuals vs. plan

If you have ever worked in an analytics role, you’ve likely gotten questions from stakeholders on how a product / team / business unit is performing.

How you present the data here matters a lot. If you simply present actuals vs. the forecast as a snapshot, it will always look like the current period is not going well:

And even if your audience is aware that the current period is incomplete, they can’t easily tell if you’ll eventually hit the goal or not.

To address this, you can show how you’re tracking towards the goal throughout the period. And to make things even clearer, you can add an extrapolation of where you’ll likely end up based on the partial data you have:

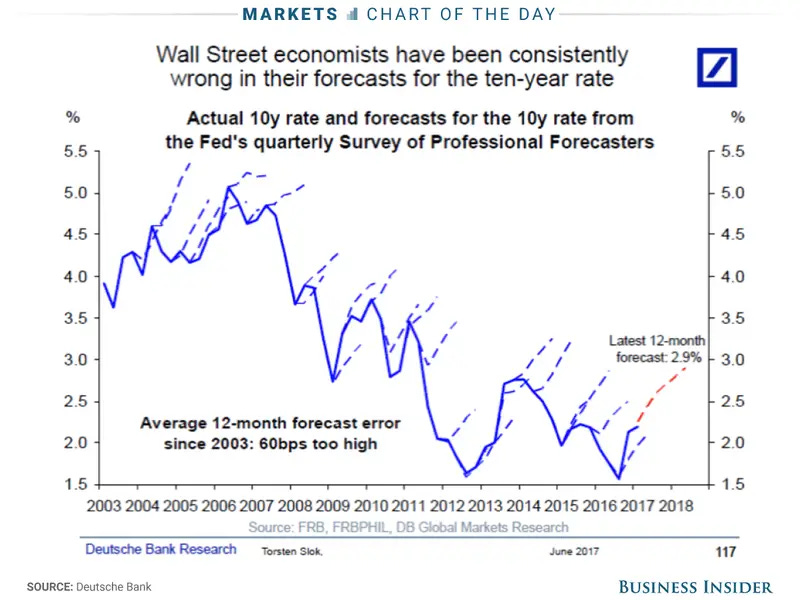

If your company regularly updates forecasts, it can be helpful to visualize how they have evolved over time. This allows you to see if you tend to be overly conservative or optimistic.

Here’s an example from Wall Street:

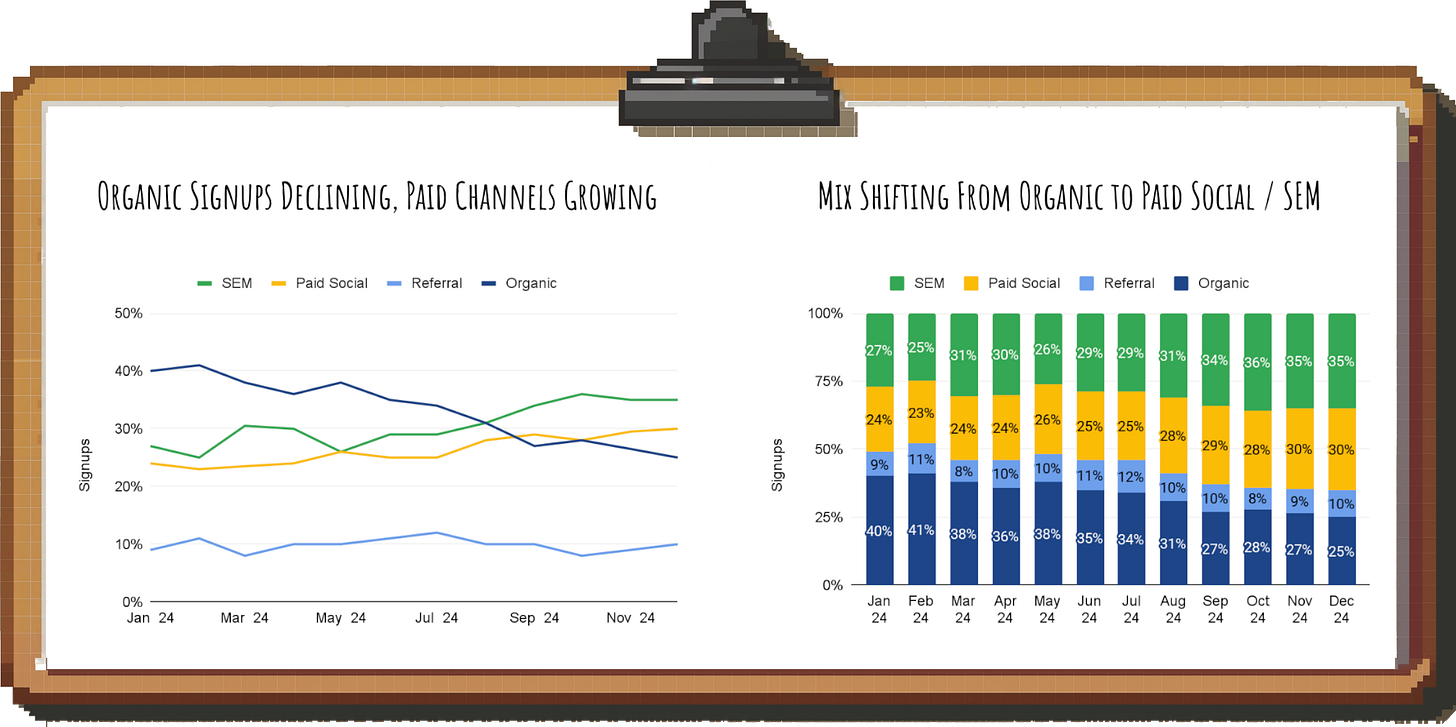

Highlighting a mix shift

Line charts are great when you’re trying to show a change over time or benchmark relative performance like in the market launch example above.

But sometimes, what really matters aren’t absolute numbers, but the changing composition of a whole; this is called a mix shift. In that case, stacked bar charts tell a much clearer story.

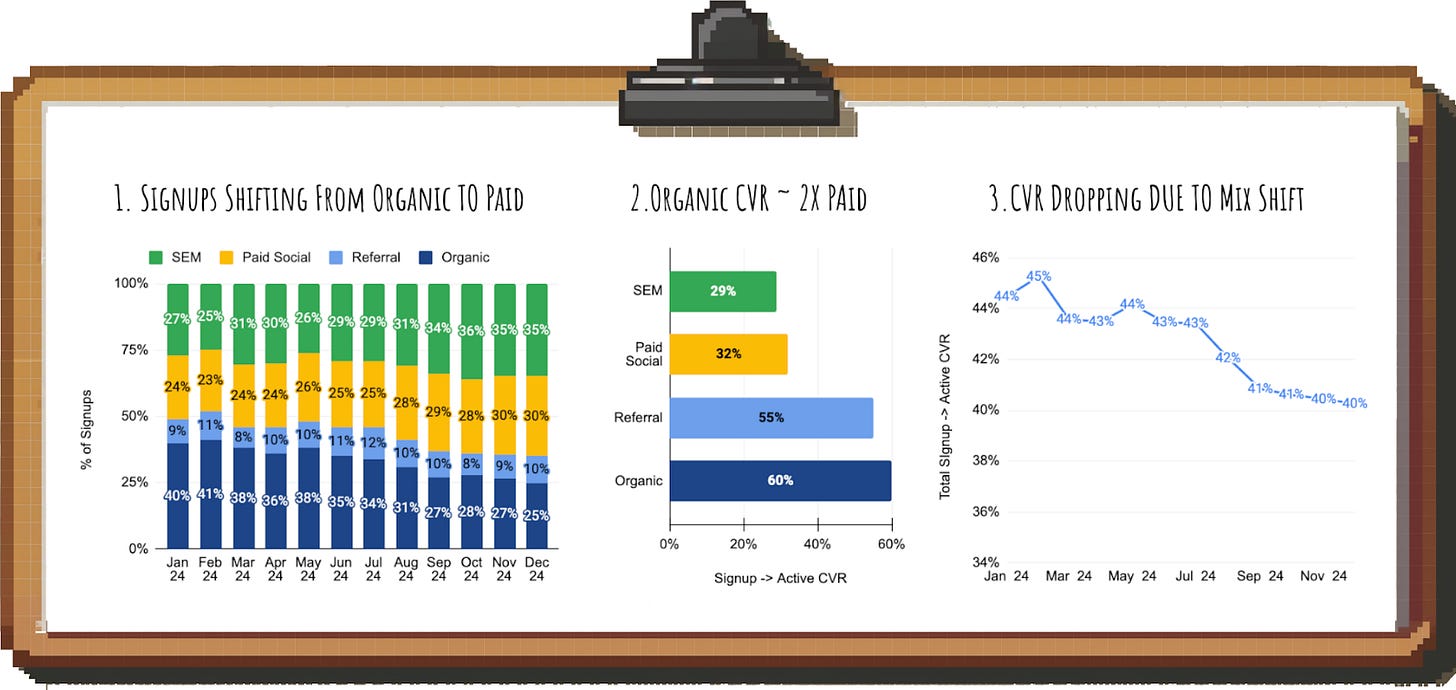

Let’s look at an example. You’re checking a dashboard and see that your overall conversion rate from signup to active user is declining. When you plot the conversion rate by user acquisition channel, it’s not clear what’s going on; the conversion rates seem fine.

A line chart of signup volume gives you a first hint, though: Some channels like Organic are declining, while paid channels like Paid Social and SEM are increasing.

Switching to a stacked 100% bar chart gives additional insights: You can now see that over the last 12 months, the share of Organic signups has dropped from 40% to 25%, while Paid Social and SEM have increased by a similar amount.

And when you put it side-by-side with the overview of conversion rates by channel, the story is crystal clear: Volume is shifting from the highest-conversion channels to the ones with the lowest conversion. As a result, the blended average conversion rate is plummeting:

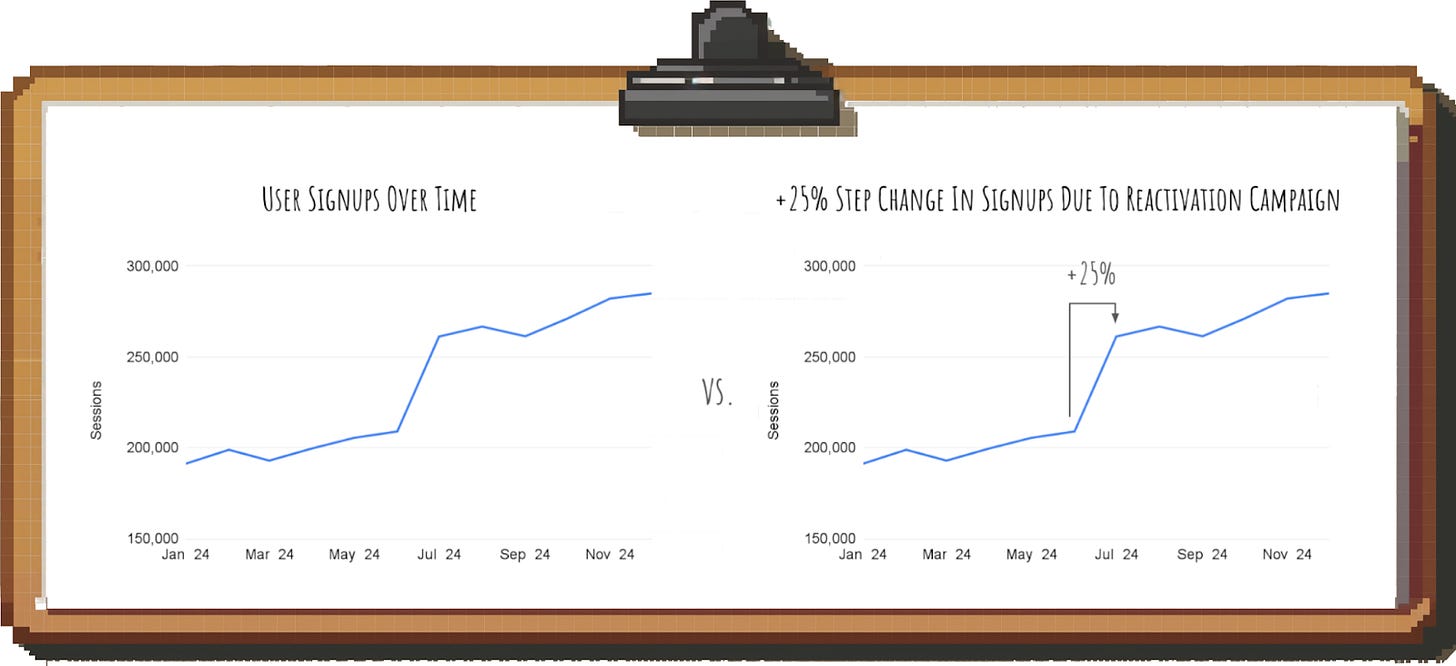

Highlighting inflection points and step changes

Everyone loves a good elbow or step change in the data. It’s not always there, but when it is, you should highlight it.

There are three ways you will encounter this in practice:

An inflection point in a trajectory. The trajectory permanently changes at a certain point; this represents a change in the growth rate

An elbow in a plot between two variables. You’ll often find that relationships aren’t linear; instead, there is often a point of diminishing returns beyond which a change in variable A leads to little change in variable B

A step change. Instead of a change in the trajectory, you’ll sometimes find one-off changes that bump a metric up or down

Often, these drastic changes can be tied to meaningful changes in the business and once you’re aware of them, it becomes much easier to make sense of the data.

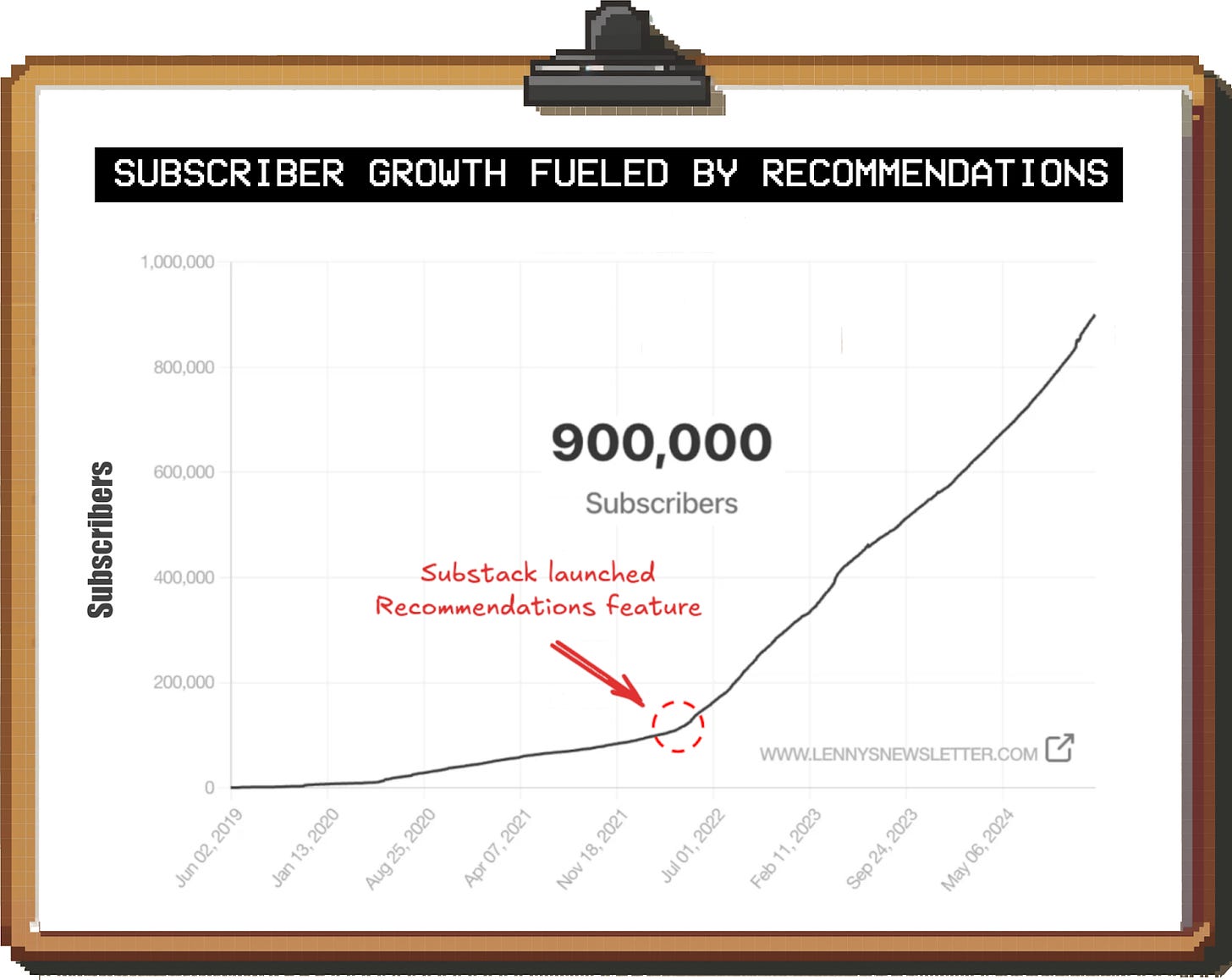

For example, here is the subscriber growth chart of

:You can see a stark inflection around May 2022. That’s because Substack launched its Recommendations feature and thousands of other newsletters started recommending Lenny.

If you want to make sense of Lenny’s subscriber data (e.g. forecast what growth he can expect in 2025), you need to make sure you split the data into two phases: “Before Recommendations” and “After Recommendations”.

Note: Just because two things happened around the same time, doesn’t mean there is a causal relationship. In this case, we could validate our hypothesis by looking at a breakdown of Lenny’s subscriber growth by channel.

Showing how to get from A to B

Showing what it takes to get from A to B is one of the most powerful data stories you can tell. The need for this comes up at work all the time:

You want to show how you plan to turn around an underperforming segment

You want to break down your company’s profit or loss, i.e. show where the money goes

You’re trying to illustrate how your startup can ultimately become profitable when it’s currently losing money on every transaction

WeWork & SoftBank taught us what not to do:

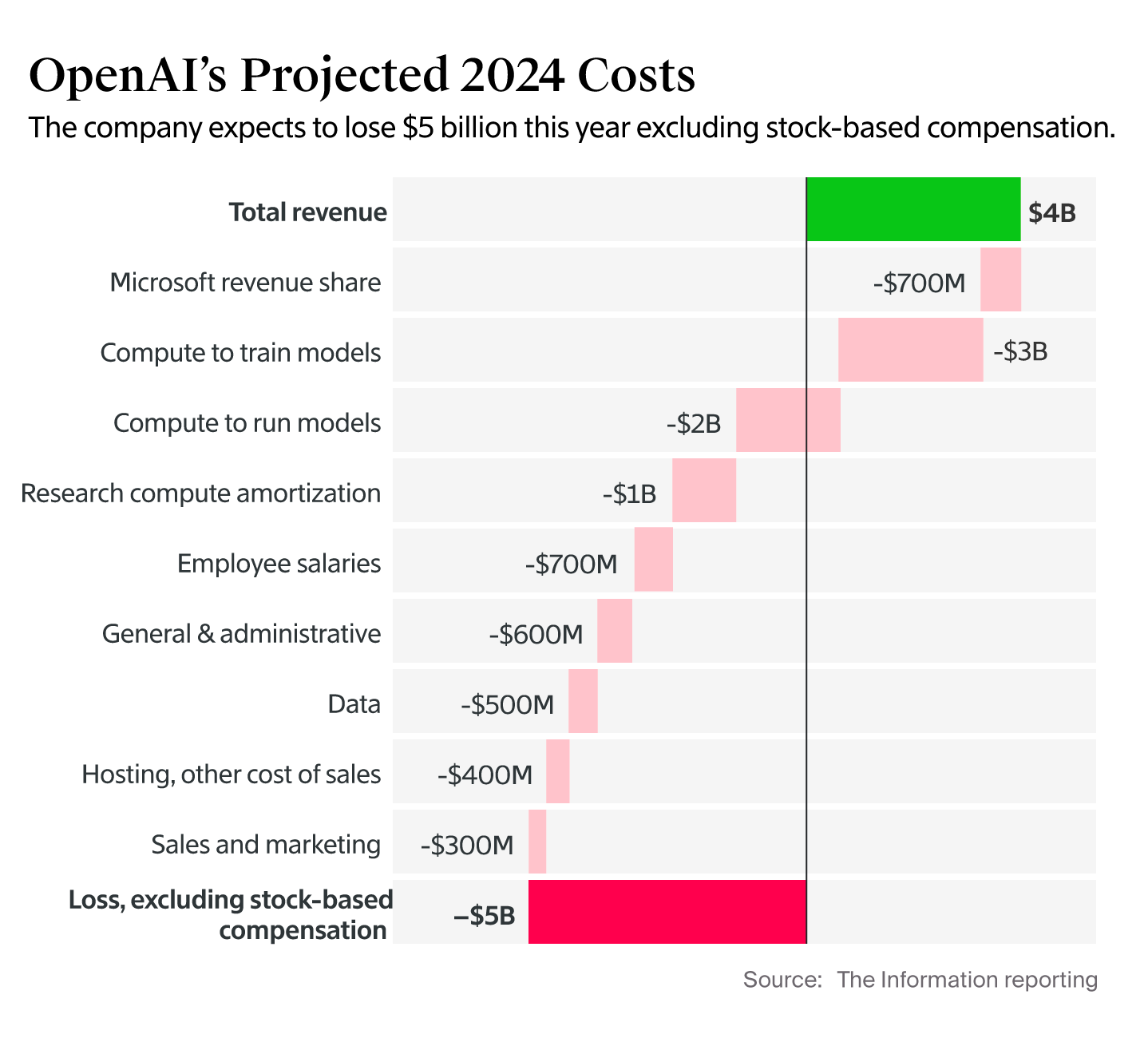

Instead, create a waterfall chart that breaks down the path from A to B. That way, you can quickly see 1) which factors play a role and 2) how much each one contributes (example from The Information’s reporting on OpenAI):

Highlighting underlying drivers

Data in isolation is difficult to interpret. So if you want to tell a clear story with data, you need to put it into context.

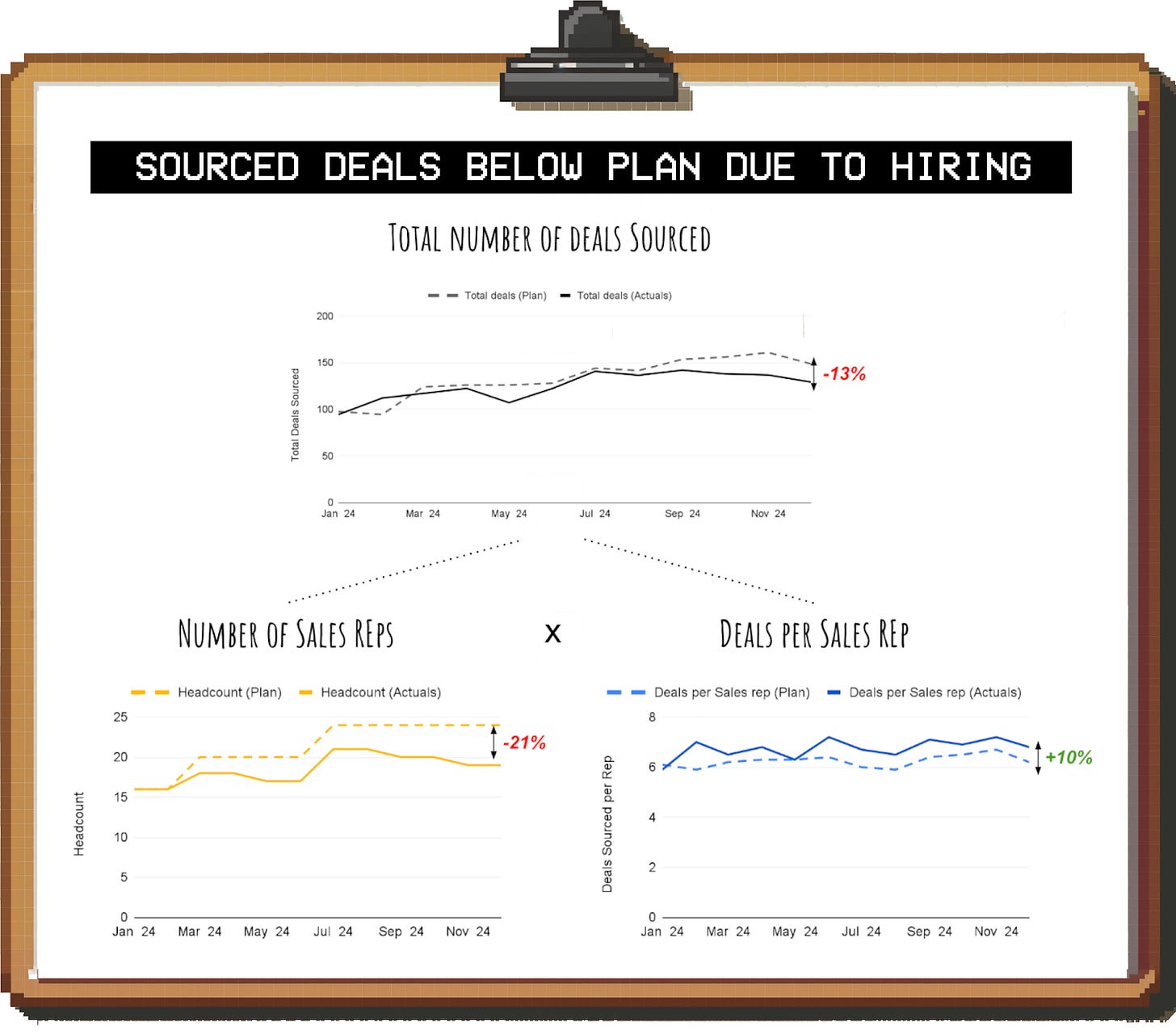

Let’s say you’re presenting a chart on the number of deals prospected by the Sales team, and it’s lower than the plan. Most people’s first assumption would be that the Sales team is not performing well and you need to increase productivity.

In reality, though, it could be a very different issue, and it’s our job to figure out what’s going on and then present it clearly. Breaking a high-level metric like “number of deals” into its drivers can be a great way to find the underlying trend that explains what we’re seeing.

For example, it could be that you didn’t hire fast enough (or had attrition on the team) and that productivity per Sales rep is actually above plan:

Best practices when presenting data

If you read the article up to this point, you have seen some of these best practices in action already.

Here’s a summary of the most important ones for your reference:

1. Make titles meaningful

How many times have you opened a presentation and looked at a chart only to wonder what it’s supposed to tell you?

There’s an easy trick to avoid that: Put the takeaway in the title of the chart (or slide). This is the Pyramid Principle in action: The reader first sees the insight in the title, and then looks at the chart for supporting data:

2. Create the storyline before you create the content

If you want your presentation to tell a coherent story, you need to sketch out the storyline before you write the actual content.

If you follow the tip above and use slide titles to communicate takeaways, doing this is easy. Just open an empty presentation and write the key points you want to make in the titles—one point per slide—so that they form a complete story end-to-end.

Only once you’re happy with the flow, you should start adding the actual content (text, graphs, tables etc.) to the slides.

Besides helping the presentation flow better, there’s another benefit: Many people that open your deck later on won’t have time to read all of it. If your titles tell a clear story, they can get the gist by just flipping through it.

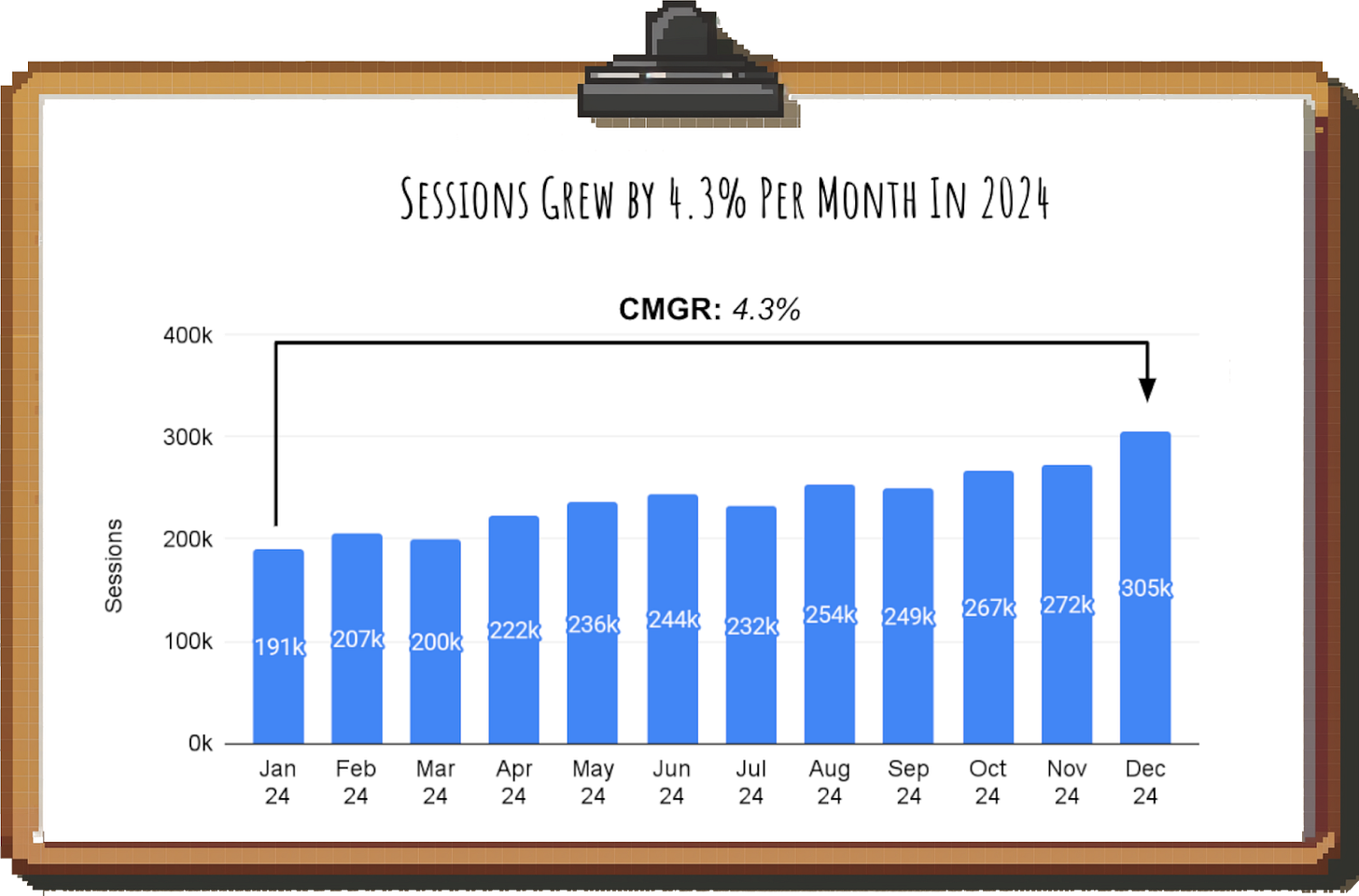

3. Visualize deltas and growth rates

If the point of your chart is to show the difference between two numbers and you just show the numbers side by side, you’re leaving the work of quantifying and interpreting the delta to your audience.

Instead, explicitly highlight the delta as a percent change (e.g. “+22% month-over-month”) or in terms of goal attainment (e.g. “80% of goal”).

wrote a great piece that dives deep on this topic.The same can be done for compound growth rates; instead of letting people calculate the growth rate over time, you can show it as a CAGR (Compound Annual Growth Rate) or the monthly equivalent directly in the chart:

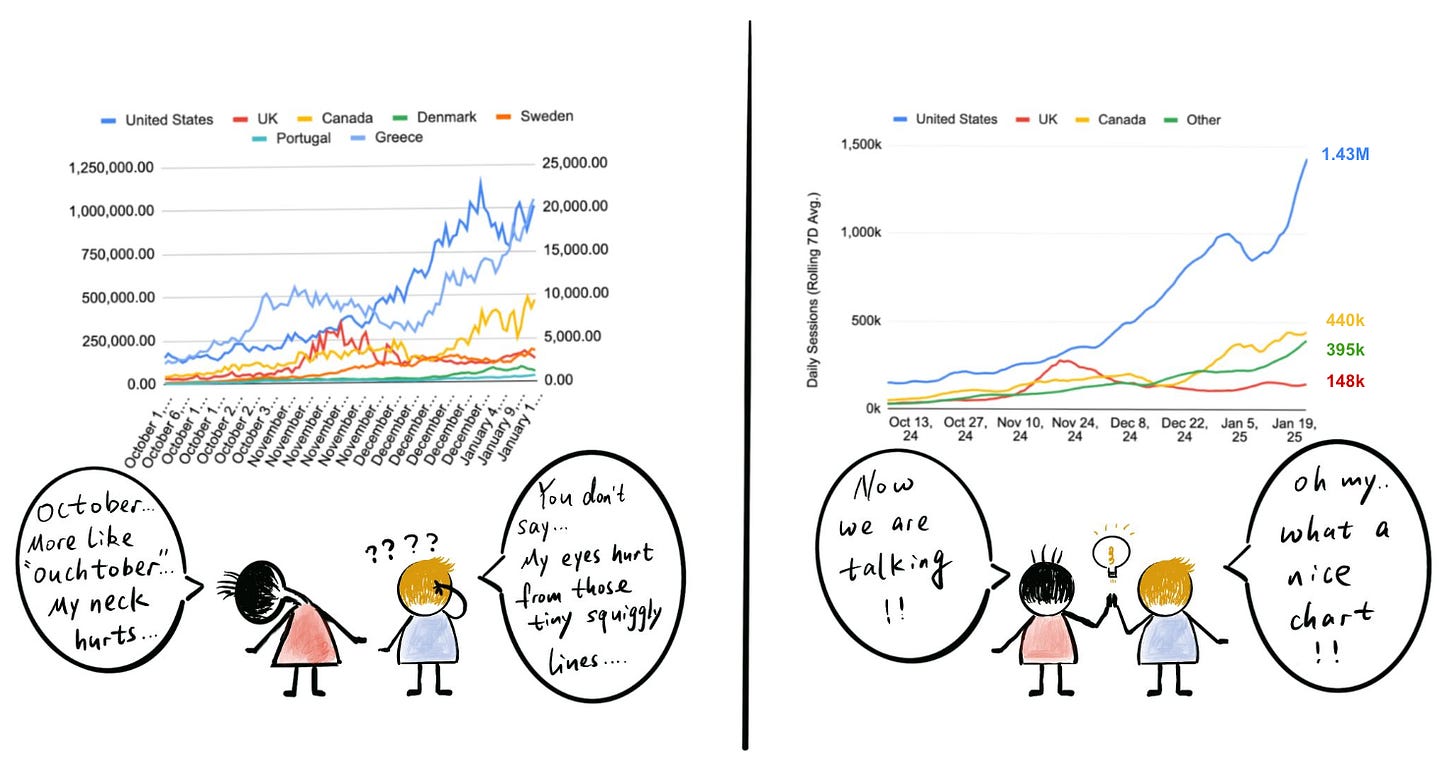

4. Make it clean

A lot of data stories don’t have the desired impact because of sloppy delivery.

This is not about making charts “fancy” or matching corporate colors or fonts. The important part is that the chart is easy to parse. Some best practices:

Clearly label your axes

Always include a legend

Smooth out granular data (e.g. daily trends)

Remove excessive detail

Here’s what that looks like in action:

5. Keep it simple

As a general rule: Avoid complex charts.

Most charts should have a single message, and usually a single axis. Only add more complexity (e.g. a second axis) if it really helps to have it in the same chart; otherwise, just create a separate chart for the other point you want to make.

The same applies to slides; a good slide should have one key message that goes in the title and is supported by data in the slide. More data != more impact.

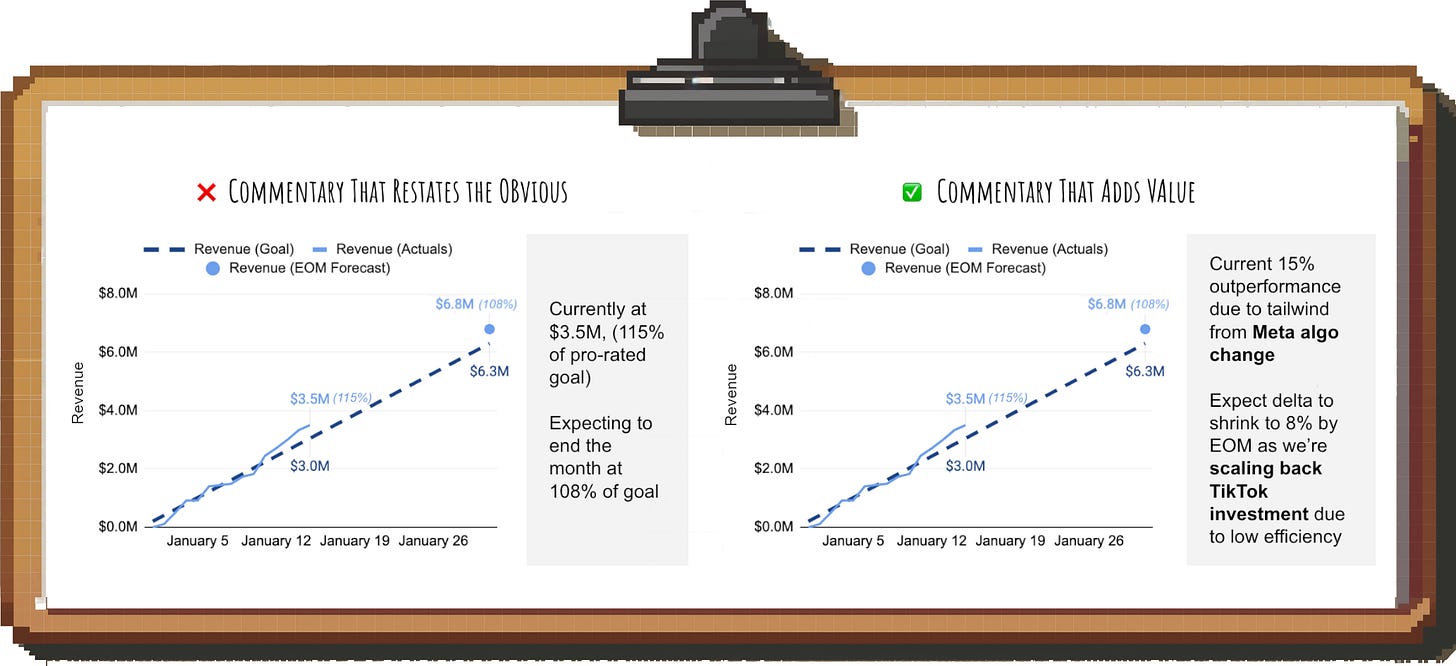

6. Provide insights, don’t just recap

Approximately 9 out of 10 data people do not write insightful commentary.

The point of comments is to add additional context or derive a “so what?”: What does this data mean for the business? In practice, though, most of the time it’s just restating what you can see in the data:

As you get more senior, it will be more and more common that your team is preparing the analysis and creating the charts, and you are only writing the commentary.

In other words, adding insightful comments will become a core skill, and it will pay off to invest in this early on.

It’s one of the easiest ways to stand out and get noticed by executives.

🔔 Data storytellers to follow

The best way to learn data storytelling is to see it in practice. Once you’ve seen enough good examples, you will automatically start applying the best practices yourself.

Here are some of our favorite data storytellers to check out:

Peter Walker from Carta (LinkedIn, Newsletter)

Jason Saltzman and Ethan Elias from Live Data Technologies

- of

- of

The Data is Beautiful community on Reddit

Who did we miss? Let us know in the comments.

This means instead of plotting the actual calendar dates on the X axis, you plot “time since launch”. And for each market, you treat the launch date (e.g. Feb ‘22 for Canada, Jan ‘23 for Australia etc.) as the starting point (Month 1) so that they all start from 0 at the same time.

Long post but really good one.

It’s probably one of the few that I have seen on DATA storytelling.

Your plots resonate so much with what I tell my team. And they align a lot with my favourite book (Cole Nussbaumer).

If you are curious about edge cases you might encounter and how to best plot them, I have a running series on data viz (currently 9 posts, probably I will get to 20) 😉

Amazing post, Tessa and Torsten! Thanks as well for the mention. Great callout on showing clear deltas 😎